how long does the irs collect back taxes

Get your transcripts from the IRS. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

How To Get Rid Of An Irs Tax Lien On Your Home Bankrate Com

After that the debt is wiped clean from its books and the IRS writes it off.

. How long can the IRS collect back taxes. This is called the 10 Year Statute of Limitations. The IRS will review the taxpayers information every two years to ensure they still qualify for tax hardship.

1 Assessed tax balance under 25000 include all assessed tax penalty and interest in computing the balance due. Six years and within the time limit for the IRS to collect the tax but you wont need to submit a financial statement. How Long Can the IRS Collect Back Taxes.

The IRS will notify you how long your meeting will last typically 3 hours and explain their wish to complete the entire process in the time allotted this is contingent on the documents you provide and whether or not you were selected for a non-correspondence audit. The IRS can collect taxes up to 10 years after you owed them with some exceptions for periods during which you lived outside the country were bankrupt or were filing for an installment agreement or an offer in compromise. This is a general rule however and the collection period can be suspended for various reasons thus extending how long the IRS has to collect.

IRS hardship rules can apply to an account for up to 10 years which is generally how long the IRS has to collect back taxes before the statute of limitations are enforced. There is a 10-year statute of limitations on the IRS for collecting taxes. Internal Revenue Service PO Box 219236 Stop 5050 Kansas City MO 64121.

If they find an increase in income and believe it to be. That is a big deal since up to now every amended tax return had to be. Here are the steps you should take if you think you owe a lot of back taxes.

It is not in the financial interest of the IRS to make this statute widely known. The IRS has announced that this summer for the first time you can amend your tax return file Form 1040-X electronically. Properly identifying how long you have before the IRS statute of limitations runs out means understanding all of the circumstances the may buy the IRS more time.

The IRS 10 year statute of limitations starts on the day that your tax. NW IR-6526 Washington DC 20224. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

We welcome your comments about this publication and suggestions for future editions. You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts. Long-term payment plan.

This means that the IRS has 10 years after assessment to collect any taxes you owe.

How Do I Know If I Owe The Irs Debt Om

Does The Irs Forgive Tax Debt After 10 Years

5 Practical Tips For Dealing With Irs Back Taxes Landmark Tax Group

Here S The Average Irs Tax Refund Amount By State

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

How Far Back Can The Irs Go For Unfiled Taxes

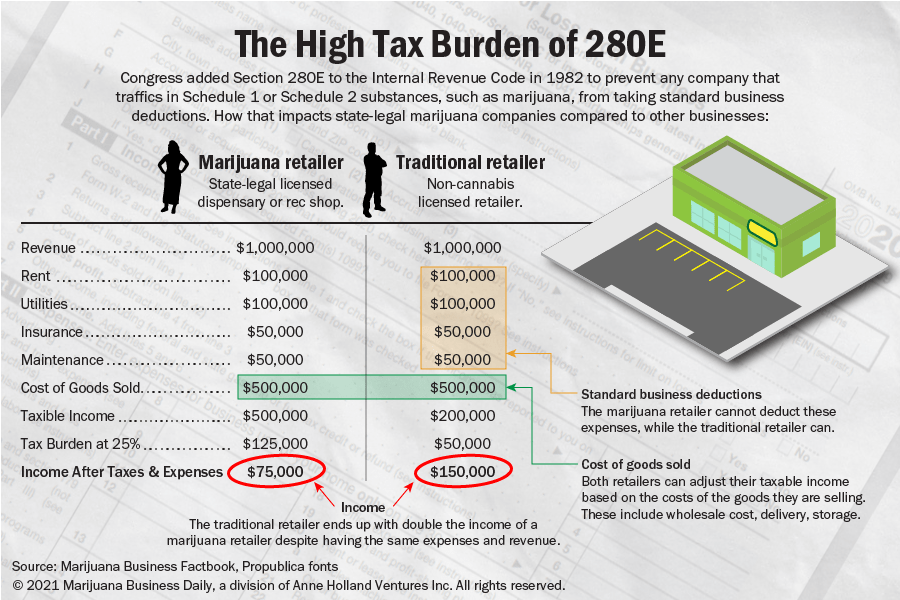

Newly Released Irs Documents Detail Effort To Collect Taxes From Marijuana Companies Under 280e

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

Know What To Expect During The Irs Collections Process Debt Com

Here S How The Irs Calculates Your Income Tax The Motley Fool

Asset Seizure What Assets Can The Irs Legally Seize To Satisfy Tax Debts

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Are There Statute Of Limitations For Irs Collections Brotman Law

Covid 19 The Irs Goes Easy On Taxpayers Who Owe Back Taxes

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Millions Of Americans Won T See Their Tax Refunds For Months Time

How Long Can The Irs Try To Collect A Debt

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor